5-minute read

If you've not yet read our introduction to Forward Pricing, you can find it here. In this article we'll explore FX Swaps, what they are, and why you might use them!

Note: there are several flavours of swaps, so it makes good practice to be attentive and specify "FX Swap", but for the sake of this article we'll now just use "swap"...

I'll swap you...

Let's start with the basics: a Spot trade involves selling one currency to buy another for immediate settlement, a Forward trade is the same, but the settlement is some future date, a Swap involves two "legs", usually a Spot and a Forward, looking something like this:

- Near Leg: Sell CCY A to buy CCY B (Spot Date)

- Far Leg: Sell CCY B to buy CCY A (Forward Date)

An FX Swap is therefore the simultaneous purchase and sale of one currency for another across two different settlement dates.

💡 Swaps are by far the most traded FX instrument, equating to about 50% of daily volume in the market.

In almost all cases one side of the trade is for a fixed amount, for example selling £1million to buy USD spot as the near leg, then later selling USD to buy back £1million for the far leg. In this example, only the USD amounts would differ due to different spot and forward rates.

It's possible to execute an uneven (or mismatched) swap where the amounts on each leg aren't the same.

The near leg of the swap doesn't have to be the Spot date, it could be any date in the future that's before the Far date. This type of swap is called a forward-forward.

Why use a Swap?

Swaps are the go-to tool for corporate treasurers as they allow for cash imbalances between dates to be managed effectively. Imagine that ABC Corp is holding $5m, has payables of £8m in two weeks, and is due to receive $5m in four weeks. Clearly, there's a $3m gap to be funded in two weeks. They could execute a swap to buy $3m for two weeks and sell $3m in four weeks, leaving their net position as +$2m in four weeks: their receipt of $5m will offset their $3m sell obligation from the far leg of the swap.

Swaps can also be used to bring in (pre-deliver) or roll forward a Forward Contract settlement date. Let's look at an example:

- ABC Corp has a Forward Contract to sell GBP and buy EUR 1million in 6 months

- Their project is delayed, meaning they now need the euros after 9 months, not 6

- They enter a Swap to sell EUR 1m in 6months and to buy EUR 1m in 9 months

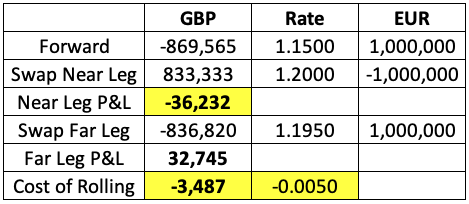

In the example above, there will be two cash flow considerations:

- The original forward rate will very likely be different to the rate of the near leg on the swap. This will create a profit or loss in GBP that will be offset upon settlement of the far leg of the swap. Near-leg losses, whilst offset later, do require funding with cash – this happens when the close-out rate (the swap near-leg in this instance) is in the money (more favourable) compared to the original rate.

- The rate for the far leg of the swap will be different to that of the near leg due to the interest rate differential (read the article linked at the start for why). This means there may be a cost or a benefit to rolling forward this trade.

Don't trip up

At Oku Markets we believe in educating and empowering our clients by being fully transparent and honest with how markets operate and our FX pricing. It's very common for FX brokers to widen spreads and exaggerate the impact of swap points on forward rollovers, unwinds, and early deliveries. Here's two tips:

- There's usually no such thing as "free" when it comes to unwinding (cancelling) a trade or taking early delivery or rolling forward. It doesn't hurt to ask for the details and call back later once you've checked it out. I say "usually" because sometimes the price difference is so small (sometimes a loss) that the broker will just wear a small loss for convenience/to do you a favour. But more often than not, "free" means there's a profit that you're not seeing!

- If there is a cost to you then it's very likely that there will be a mark-up applied to the bank/broker's costs. This is fine and, it's absolutely fair and normal practice to charge a little for work, but sometimes these costs are inflated to maximise income on what is usually a very straightforward transaction. Rollovers and cancellations can be big money-makers, so if the cost sounds a little high then ask for the workings out and check them independently.

Want to know more?

Our philosophy at Oku Markets means no smoke and mirrors, and complete transparency with pricing and how markets operate.

You can contact us for a review of your currency processes and for our guidance and suggestions at info@okumarkets.com or 0203 838 0250.

Thanks for reading 👋