3-minute read

If you read our blog post on Value at Risk (VaR) then you'll know we recommend running VaR alongside stress testing as VaR doesn't tell you how bad things might get in a catastrophic blow-up event.

What If?

Stress testing gives a straightforward mechanism to subject a portfolio to extreme market events by altering one variable at a time and analysing the impact. We can think of stress testing as a "what if" analysis!

The most common variable to adjust is the underlying spot exchange rate, but you might find it useful to test extremes in volatility if you have currency options within your portfolio.

Businesses engaged in FX hedging have underlying currency exposures brought about by international trade or international assets or liabilities. When mitigating action is undertaken – placing hedging trades with derivatives – this brings about different risks.

The most common applications are testing the impact on...

- ...inherent currency risk by adjusting the spot rate

- ...residual currency risk by adjusting the spot rate

- ...mark-to-market position by adjusting the spot (/forward) rate

- ...expected hedge performance by adjusting the spot (/forward) rate

💡Inherent risk is the risk before mitigating action is taken (hedging), whilst residual risk is the risk that remains after the effect of the hedges

Don't stress out

By understanding how your underlying currency exposure changes as the spot rate moves, you'll be able to make better decisions, quantify your risk level with more accuracy, and determine whether the resultant position is within your risk tolerance.

Knowing how your portfolio of FX trades changes in value with movements in the spot (/forward) rate and with volatility, you'll know your margin call risk, be able to recognise any overweight splits between your FX counterparties, and have a clear idea on how hedges will perform (the realised rate – very important for path-dependent trades).

Quantitative over Qualitative?

Regular stress testing gives you the ability to assess the effects of sizeable changes in market risk factors. These tests should be both quantitative and qualitative!

Here's an example: If the spot rate moves +/-10%...

- How would our pricing strategy be impacted?

- How might customer demand change?

- What actions would the Finance or Risk Management teams take?

- What might our competitors do?

Currency movements in the region of 10-20% are significant and have obvious impacts on margins, profitability, competitiveness, and the balance sheet. But what knock-on impacts could there be, say to future investment, budgets for talent, payment of dividends, creditworthiness and so on.

Isn't this a bit over the top?

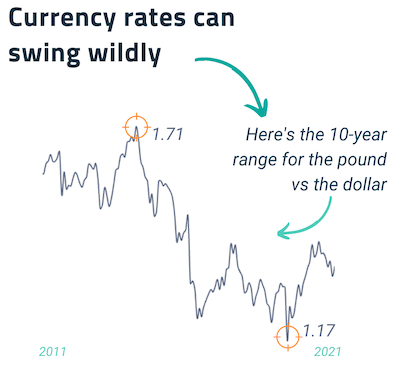

Exchange rates can change enormously over time, and sometimes in a very short period. Remember the EU Referendum and the ~20% drop in the value of the pound? Businesses simply must plan for moves of this magnitude!

Need Help?

Fortunately, we'll do the heavy-lifting and the number-crunching for you.

You can contact us for a review of your currency processes and for our guidance and suggestions at info@okumarkets.com or 0203 838 0250.

Thanks for reading 👋