4-minute read

The word Policy sounds so formal, doesn't it? It conjures up thoughts of big documents, strict rules, and red tape. But it doesn't have to be that way...

In this article, we'll look at the benefits of working to a policy, what should be included as a minimum, and where to turn for help.

So what is an FX Policy?

It's your agreed approach to how you manage your business currency risk and operations. The policy will include rules and guidelines which inform decisions and actions – the purpose is to provide the organisation with a framework for currency management that's designed to achieve a set of objectives and is agreed upon by the Board.

Many owner-managed businesses tend to approach currency management in an opportunistic or entrepreneurial way, with one person calling the shots. Of course, it's the owner's right to make those decisions, but it can produce volatile results which in turn can hamper business performance and progress.

The policy does not have to be a long-winded and complex document full of strict rules and regulations; it can be as simple as a 1-page document outlining the FX strategy, or a detailed document that provides clarity on every stage of the process.

Why bother?

There are many good reasons why every business should have some kind of written policy for their currency management. Here's a selection of the big ones:

- Accountability is shared, reducing key-person risk

- Reduced risk of emotional decision making

- Less chance of a bad market call impacting the business

- Strong governance is demonstrated to investors, clients, and suppliers

- The policy brings structure, which yields more predictable results

- Performance to objectives can be measured

- A clear framework for how to operate prevents indecision

Basically, the point is to provide a structure that governs what, how, when, and why currency decisions are made.

What should be included?

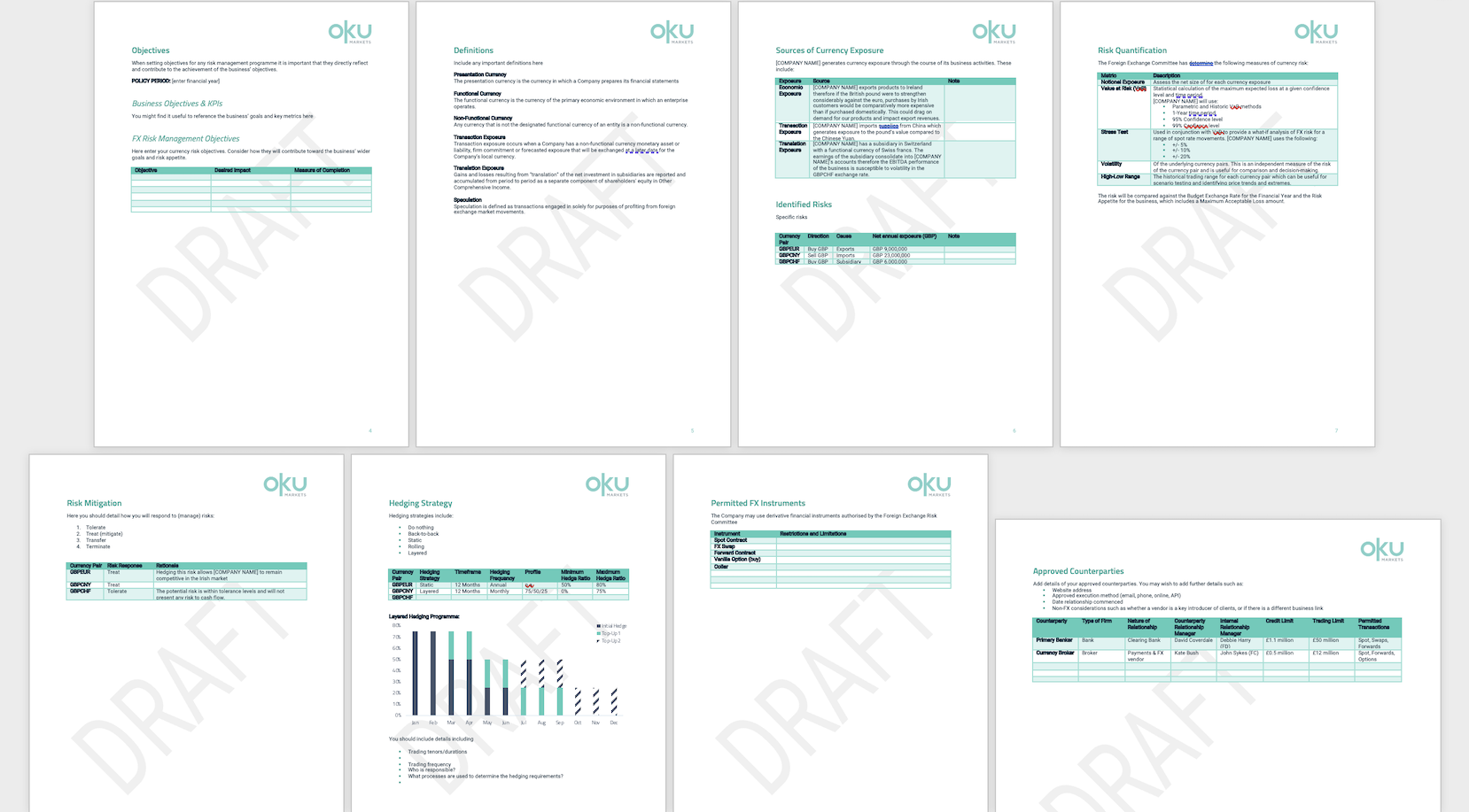

As a minimum, we recommend the following areas are covered in a policy:

- Sources of Currency Risk

- Hedging Objectives

- Hedging Strategy

- Permitted FX Instruments

- Roles and Responsibilities

Beyond this, a more detailed policy might include:

- Definitions

- Risk quantification (and methods)

- Risk mitigation programme (incl. non-derivative hedging)

- Approved counterparties

- Risk and exposure limits

- Controls and monitoring

- Accounting procedures

Need help?

At Oku Markets we've developed many FX Policies for businesses and organisations. We can guide you through the detail on complex financial instruments, how to create an effective hedging strategy, and even provide you with our Policy Template!

You can contact us for a review of your currency processes and for our guidance and suggestions at [email protected] or 0203 838 0250.

Still not convinced?

It's important to be aware of these truths:

- Nobody knows where FX rates will go from one day to the next

- You cannot control the FX market, but you can manage your exposure

- Humans make irrational decisions due to our cognitive biases, especially with risk

- A currency risk policy, even a simple one, enables better decision making

- Firms that risk manage experience better long-term financial performance

Thanks for reading 👋