4-minute read

Another boring, technical article? Sort of, but it's something that comes up frequently when dealing with businesses that have exposure in two main foreign currencies, for example, UK companies that deal in both euros and dollars.

Let's start with a definition: cross-currency triangulation is the process of converting one currency into another via a third, common currency. For example, using the USDCAD and USDMXN exchange rates to derive the CADMXN rate.

Crossing Currencies

Currencies are mostly quoted against the US dollar, and there are market conventions as to the order of precedence in terms of a currency pair's base and counter-currency (also called the term or quote currency). For example, in the currency pair USDJPY, USD is the base currency, and JPY is the term/counter/quote currency.

The exchange rate of a non-dollar currency pair is called a cross rate. For example, CHFJPY would give the value of one Swiss franc into Japanese yen.

This is an important feature of the FX market: the ability to quote an exchange rate in currency pairs that are not traded in the interbank market allows for greater flexibility, increased efficiency of trading, and increased opportunities for everybody.

Triangulation

The implementation of the euro brought about new conventions for converting between the euro and other currencies on a cross-currency basis via triangulation with the dollar. Since then, many cross-currency pairs have developed and it is easier to obtain pricing in just about any currency pair via an electronic dealing platform.

Let's stick with our cross-currency pair from earlier, CHFJPY. We will already know the rate for USDCHF and USDJPY, so it's just a matter of working through the formula.

Here's a simple formula that's easy to remember: AB x BC = AC (or AB ÷ CB = AC)

- A = CHF

- B = USD

- C = JPY

So CHFUSD x USDJPY = CHFJPY

- USDJPY = 143

- USDCHF = 0.9650 (hence CHFUSD = 1.0362 (1÷0.9650 gives the inverted rate))

- CHFJPY = 143 x 1.0362 = 148.18

Look at the Charts!

I mentioned that this concept comes up in conversation regularly with businesses that have exposure to two currencies – let's see why:

Question: "why has the pound dropped so much against the dollar, but not the euro?"

Ignoring the potential reasons and factors for driving the prices (read more about drivers of FX prices in our blog post), intuitively we know that the answer must have something to do with the price of the euro vs the dollar.

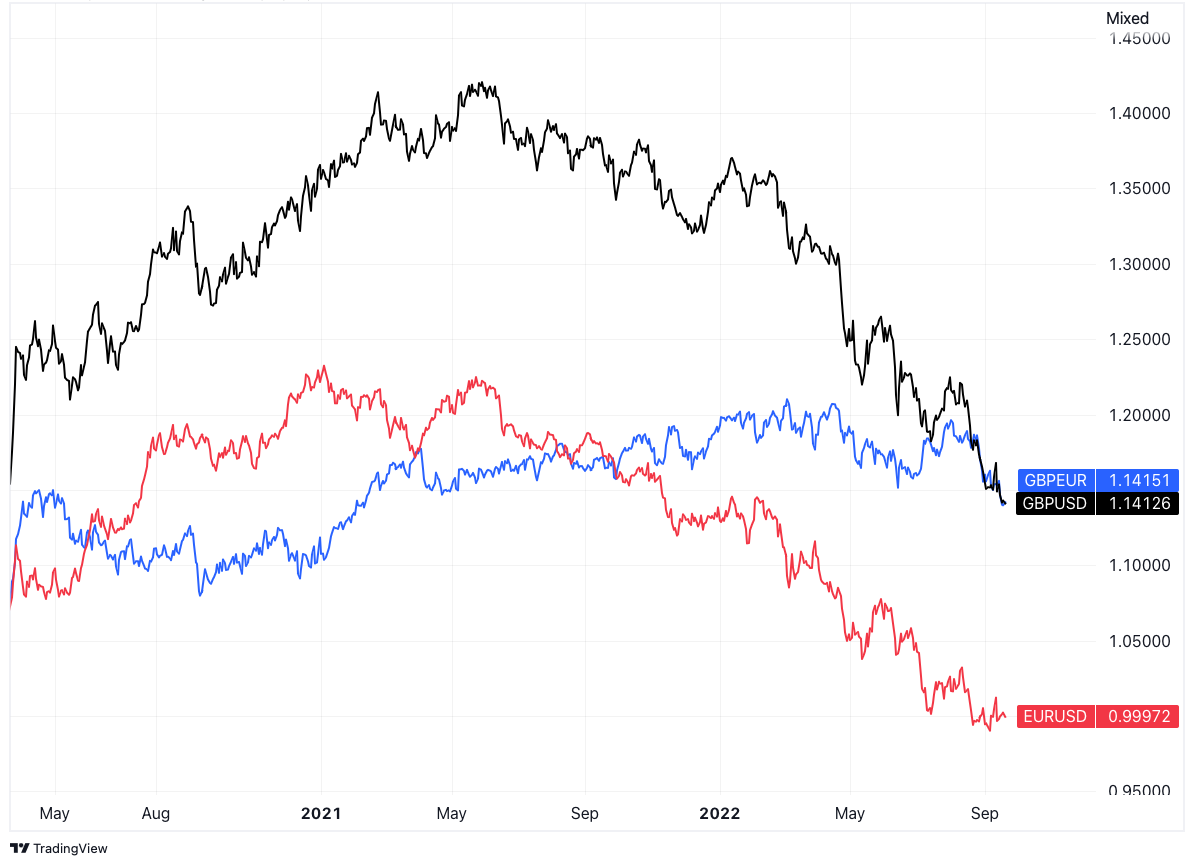

The chart below shows how GBPUSD dropped around 20% from its peak whilst GBPEUR was basically flat – because there was a large move lower in EURUSD, too.

What if?

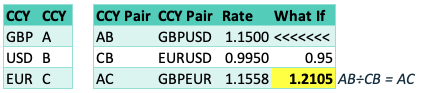

If we can calculate cross-rates using the triangulation formula then we can easily prepare a "what if" scenario. For example, what if EURUSD drops from 0.995 to 0.950 due to an isolated event(s) within Europe which means the pound doesn't drop against the dollar but instead stays flat? Then the GBPEUR cross-rate would push up from 1.1558 to 1.2105.

This is actually quite useful for considering isolated, domestic events that have an impact on one currency's value (Brexit is a good example).

Need our help?

We're proud to work transparently with our clients, and we work hard to break the asymmetry of knowledge and information in the FX market.

You can contact us for a review of your currency processes and for our guidance and suggestions at info@okumarkets.com or 0203 838 0250.

Thanks for reading 👋